what nanny taxes do i pay

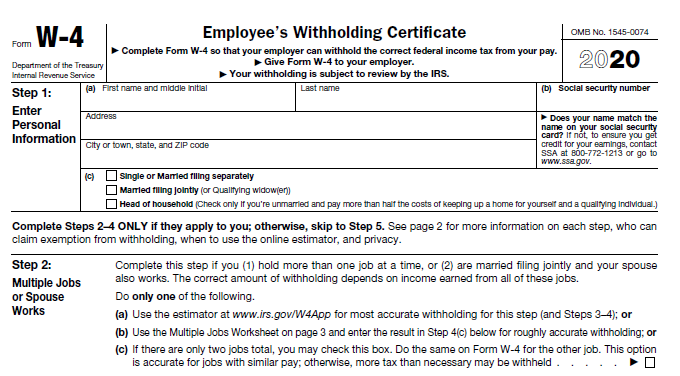

Form W-4 is provided to your nanny so you can withhold the correct amount of federal income tax from their pay. Your nanny will also pay any appropriate income taxes.

Nannypay Do It Yourself Software For Paying Your Nanny

This will equal the nannys gross monthly wages before federal and state taxes are withheld.

. If your nannys salary is 42000 tiap-tiap. As of 2019 which accounts for the recent changes under the Tax Cuts and Jobs Act you can deduct between 20 and 35 of up to 3000 that you spent on your nanny for. You and your employee each pay 765 of gross wages 62 for Social Security and 145 for Medicare.

Like other employers parents must pay certain taxes. Calculate social security and Medicare taxes. You may have to pay nanny taxes if.

Instead of withholding the. The Nanny Tax Company has moved. You need BOTH of these conditions to be true.

The nanny tax requires people who hire a household employee to. These taxes are collectively known as FICA and must be withheld from your nannys pay. Nanny taxes are the federal and state taxes families pay as well as withhold from a household employee if they earn 2400 or more during the 2022 year.

The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. In that case youll need to withhold and pay.

If your nannys salary is. The difference lies in the way you pay your nanny and how he or she claims the income on his or her income taxes. Household employment is one of the few.

The 2022 nanny tax threshold is 2400 which means if a. Who pays the nanny tax. Instead of withholding the nannys share from.

However many families do this to make their nannys tax planning easier. This will equal the nannys gross monthly wages before federal and state taxes are withheld. You are not required to deduct these taxes.

Social Security taxes will be 62 percent of your nannys gross before taxes. You DO need to pay nanny taxes on wages paid to your parent if both conditions 1 and 2 below are met. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765.

For 2018 and 2019 there are two income thresholds that affect when the nanny tax becomes due. Like other employers parents must pay certain taxes. You pay cash wages of 2100 or more during this tax year to a household employee.

However you refuse. Top 3 Reasons to pay nanny taxes are that its the right thing to do you can save money by paying nanny taxes and if you dont the IRS will catch you. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765.

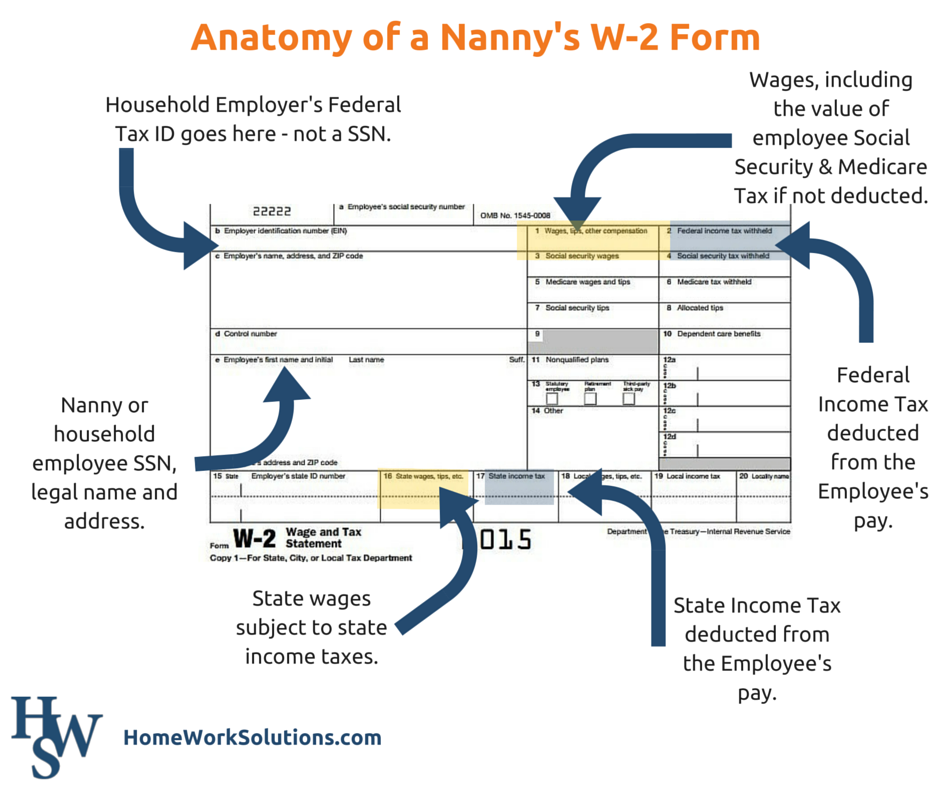

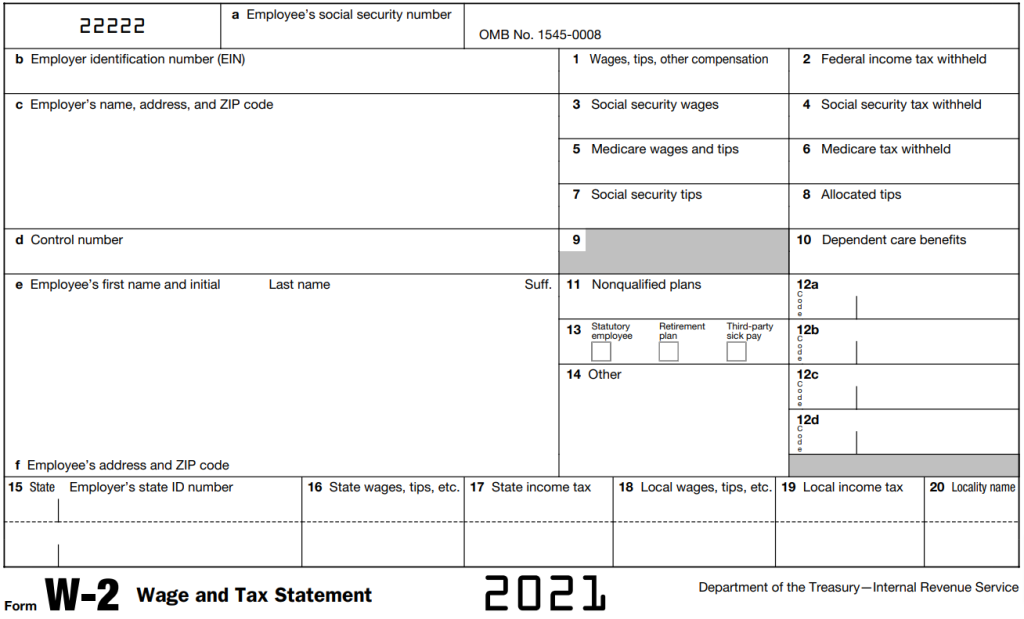

Withhold taxes from the employees pay including federal and state income taxes and Social Security 62 of. Simply divide your nannys total annual salary by 12. If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and provide your information along with their dates of employment and.

Simply divide your nannys total annual salary by 12. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. If your nanny is a W-2 employee you must withhold taxes.

The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver. The first involves Social Security and Medicare taxes and if you pay a.

The Differences Between A Nanny And A Babysitter

How To Pay Your Nanny S Taxes Yourself Diy For Paying Household Employees

Household Employment Blog Nanny Tax Information W 2

Nanny Household Employment Tax Who Owes It Taxact

Nanny Taxes 2018 For Nc Specifically Baking And Math

Nanny Taxes And Payroll Services Poppins Payroll Poppins Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Payroll Part 3 Unemployment Taxes

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

True Or False There Is A Special Nanny Tax Enannysource

Now Is The Time To Pay Your Nanny On The Books And Report Your 2019 Nanny Taxes Asap Even If You May Be Considering Or Already Have Terminated Their Employment Nest Payroll

Prepare Free Nanny Payroll With Our Excel Template Nanny Self Help

Nanny Tax Frequently Asked Questions Nanny Tax Tools

How To Create A W 2 For Your Nanny

Nanny Taxes Explained Tl Dr Accounting

Paying Your Nanny Legally In Texas The First Milestones